Corporate Transparency Act – What You Need to Know

Corporate Transparency Act – What You Need to Know

Beginning on January 1, 2024, the U.S. Treasury Department will be implementing heightened transparency disclosure requirements on US corporate entities. These new requirements include disclosing all beneficial owners of US corporate entities for the purpose of preventing white collar crime including money laundering, terrorism financing, and drug trafficking. The Corporate Transparency Act (“CTA”) was passed in early 2021 as part of the National Defense Authorization Act by the Financial Crimes Enforcement Network (“FinCEN”) which is a division of the U.S. Treasury Department.

Reporting Requirements

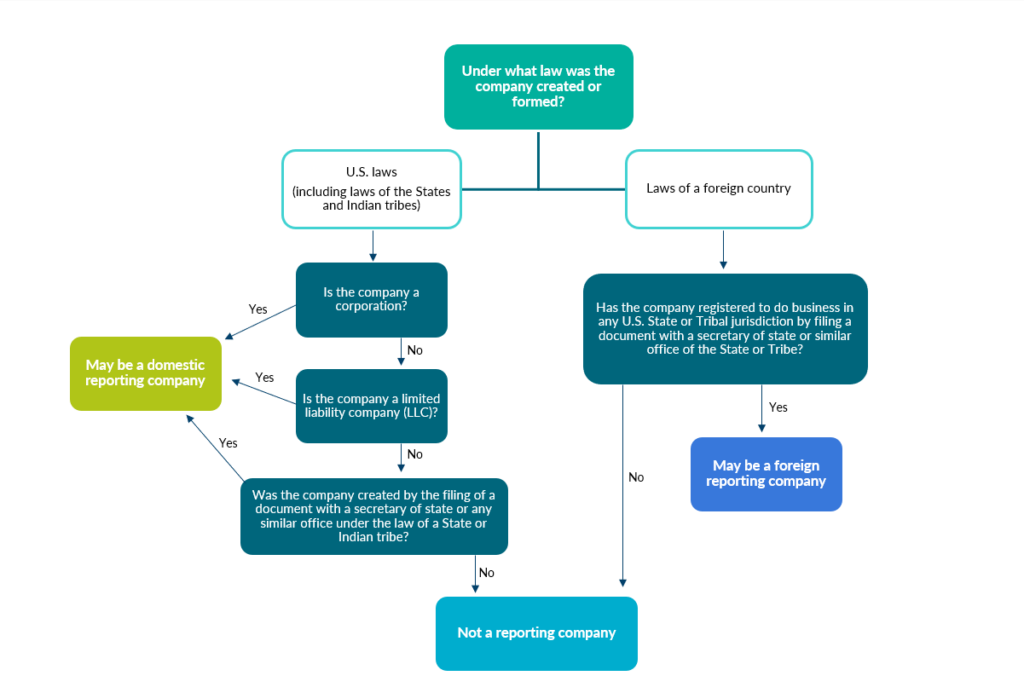

Not all companies are required to report BOI to FinCEN under the Reporting Rule. If your company is neither a “domestic reporting company” nor “foreign reporting company” because it does not meet either definition or it qualifies for an exemption, then it is not required to file a BOI report with FinCEN.

Reporting Company Exemptions

The Reporting Rule exempts twenty-three (23) specific types of entities from the reporting requirements listed in the chart below. An entity that qualifies for any of these exemptions is not required to submit BOI reports to FinCEN.

To clarify with respect to the tax-exempt entity and large operating company exceptions above, entities such as churches, charities, nonprofit entities, or other organizations that are tax exempt under Section 501(c) of the Internal Revenue Code (regardless of whether they have applied for exempt status) and charitable trusts under Section 4947(a) of the Internal Revenue Code are not required to comply with the CTA’s reporting obligations. Large operating companies are also exempt. This is defined under the CTA as any entity that (a) employs more than 20 full-time employees in the U.S., (b) has an operating presence at a physical office within the U.S., and (c) reported more than $5 million in gross receipts or sales from U.S. sources only on its prior year federal tax return.

Beneficial Owner

If your company is a reporting company, your next step is to identify its beneficial owners. A beneficial owner is any individual who, directly or indirectly: (a) exercises substantial control over a reporting company; OR (b) owns or controls at least 25 percent of the ownership interests of a reporting company; OR (c) both. A reporting company can have multiple beneficial owners. (note: reporting companies are not required to report the reason that an individual is a beneficial owner)

Step 1: Identify individuals who exercise substantial control over the company.

Step 2: Identify the types of ownership interests in your company and the individuals that hold those ownership interests.

Step 3: Calculate the percentage of ownership interests held directly or indirectly by individuals to identify individuals who own or control, directly or indirectly, at least 25 percent of the ownership interests of the company.

(a) Substantial Control

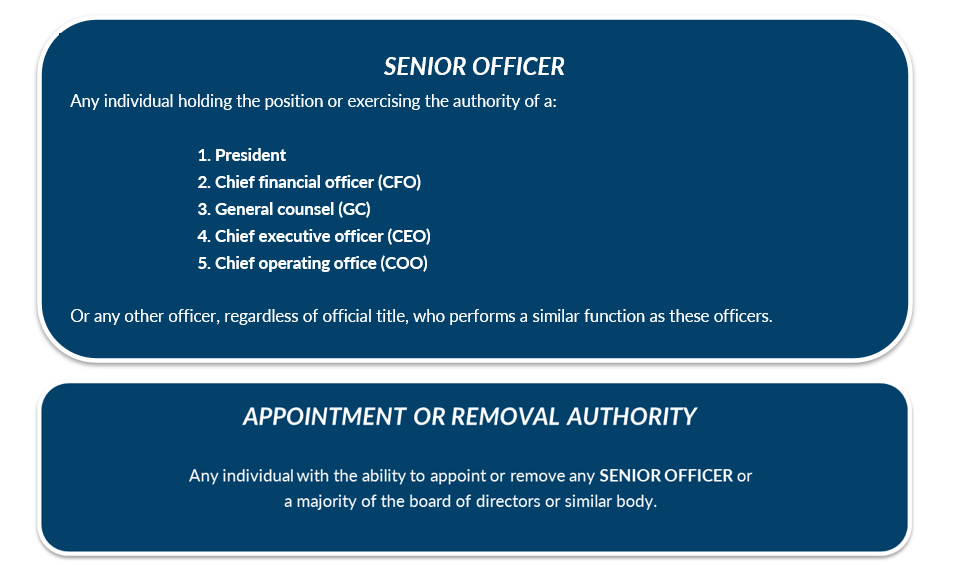

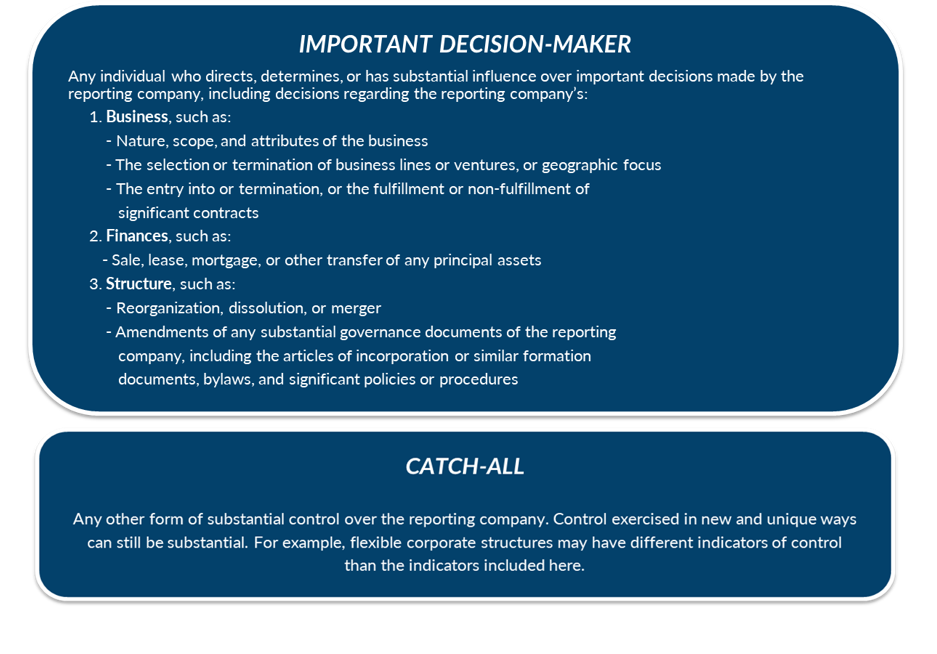

Reporting companies are required to identify all individuals who exercise substantial control over the company. There is no limit to the number of individuals. An individual exercises substantial control over a reporting company if the individual meets any of four general criteria:

[Note for trusts: a trustee of a trust or similar arrangement may exercise substantial control over a reporting company]

(b) Ownership Interest

Reporting companies are required to identify all individuals who own or control at least 25 percent of the ownership interests of the company. A reporting company may have multiple types of ownership interests. Such as:

Beneficial Owner Exceptions

There are five exceptions to the definition of beneficial owner. These include if the individual is (1) a minor child, or (2) a nominee, intermediary, custodian, or agent, or (3) employees who do not control the business and are not senior officers, or (4) an inheritor with a future interest in the company, or (5) a creditor. When an owner qualifies for an exception, the reporting company does not have to report that individual as a beneficial owner in its BOI report to FinCEN.

Reporting Timeline – Entities Created:

Before January 1, 2024

Entities created before January 1, 2024, have until January 1, 2025, to file their initial report.

After January 1, 2024, but before January 1, 2025

Entities created after January 1, 2024, but before January 1, 2025, currently have 90 calendar days following incorporation to file the BOI report. FinCEN extended the filing deadline on November 29, 2023 only for entities created during the 2024 calendar year.

After January 1, 2025

Entities created after January 1, 2025, will have 30 calendar days to file their initial BOI reports with FinCEN. FinCEN’s recent November 29, 2023 rule change did not alter the 30 day requirement for entities formed after January 1, 2025.

Electronic Filing

Filing BOI reports will be done electronically through an online interface. FinCEN is currently designing and building a new IT system called the Beneficial Ownership Secure System to collect and store CTA reports, but this system will not be available for filing purposes until January 1, 2024. According to FinCEN, the filing system will be secure, and the information provided to FinCEN will not be accessible by the public but may be disclosed to other government agencies.

Mistakes and Changes of Filing

If any inaccuracies are identified in a BOI report made by a reporting company, FinCEN has stated a correction must be made within 30 days before being penalized.

The final rule imposes a rolling obligation on reporting companies to update information as it changes or becomes inaccurate. An annual filing is not appropriate as a comprehensive standard with the CTA.

Required Information Checklist

The following is information about your company, its beneficial owners and company applicants that you are required to collect and report.

Reporting Company:

- Full legal name

- Any trade name or “doing business as” (DBA) name

- Report all trade names or DBAs.

- Complete current U.S. address

- Report the address of the principal place of business in the United States, or, if the reporting company’s principal place is business is not in the United States, the primary location in the United States where the company conducts business.

- State, Tribal, or foreign jurisdiction of formation

- For a foreign reporting company only, State or Tribal jurisdiction of first registration

- Internal Revenue Service (IRS) Taxpayer Identification Number (TIN) (including an Employer Identification Number (EIN)

- If a foreign reporting company has not been issued a TIN, report a tax identification number issued by a foreign jurisdiction and the name of such jurisdiction.

Each Beneficial Owner and Company Applicant:

Note: Not all reporting companies are required to report information about company applicants.

- Full legal name

- Date of birth

- Complete current address

- Report the individual’s residential street address, except for company applicants who form or register a company in the course of their business, such as paralegals. For such individuals, report the business street address. The address is not required to be in the United States.

- Unique identifying number and issuing jurisdiction from, and image of, one of the following no-expired documents:

- U.S. passport

- State driver’s license

- Identification document issued by a state, local government, or tribe

- If an individual does not have any of the previous documents, foreign passport

Note: If an individual has obtained a FinCEN identifier and provided it to a reporting company, the reporting company may include such FinCEN identifier in its report instead of the information required about the individual.

Penalties for Failure to File

Deliberate non-compliance or providing false information to FinCEN can result in penalties up to $500 for each day of the violation. Criminal penalties include imprisonment for up to two (2) years and/or a fine up to $10,000.

Please contact the firm for further guidance if you have any questions about the CTA and what resources the firm can direct to for compliance purposes.